The AI ecosystem is experiencing a once-in-a-generation investment cycle. Hyperscalers are pouring unprecedented capital into training infrastructure, data centers, and specialized hardware. The scale of spend — and the speed at which it’s accelerating — has raised an important question for investors:

What happens if we are in an AI bubble? And who is positioned to benefit (or get hurt) if the capex cycle overshoots?

A recent piece from Sparkline Capital, Surviving the AI CAPEX Boom offers a useful historical lens. Throughout technological build-outs — railroads, fiber, early cloud — infrastructure investors often absorbed the pain, while downstream adopters captured the gains created by overcapacity and falling unit costs.

Stackpoint’s model is intentionally designed to operate in that downstream layer. We build vertical, AI-native software companies in sectors where automation delivers measurable ROI and where application-layer economics strengthen as compute becomes more abundant.

Below is how we think about this moment — and why our portfolio of vertical, AI-native software companies is structurally advantaged in both boom and correction scenarios.

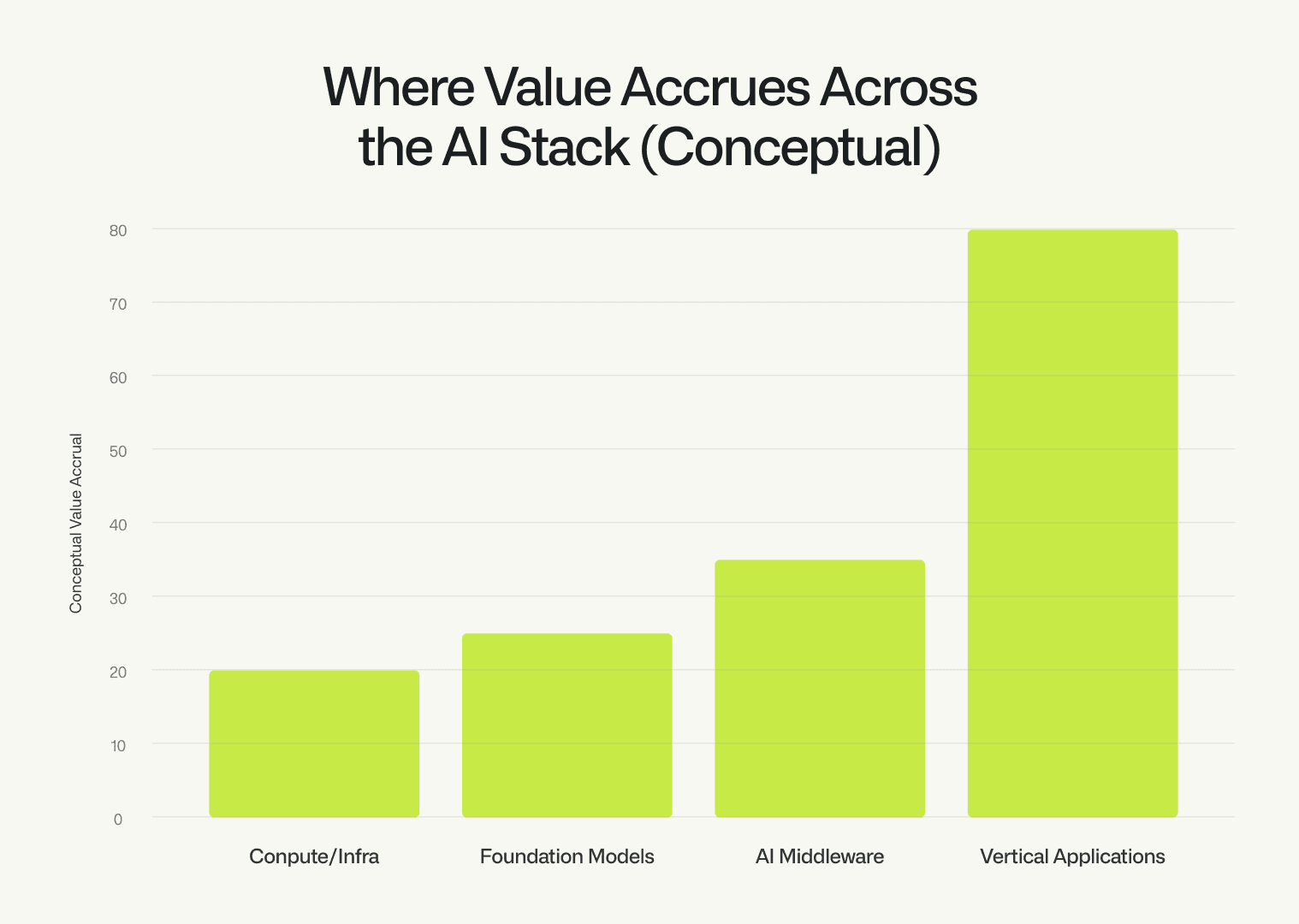

1. We Play Where Value Pools Form: The Application Layer

The infrastructure layer — GPUs, data centers, energy — is becoming increasingly expensive, competitive, and concentrated. As hyperscalers spend tens of billions to out-scale one another, returns in that layer may face pressure.

Historically, this dynamic creates a very different opportunity downstream.

As infrastructure becomes cheaper and more capable, application-layer companies benefit from “bubble subsidies”:

declining cost of inference

increasing performance per dollar

faster iteration cycles

lower barriers to deploying advanced AI into real workflows

Some say that as foundation models improve, the application layer gets thinner. The evidence says the opposite. Better models compound the value of application-layer orchestration — the scaffolding that decides when to trust a model, what data to feed it, and how to format outputs to the exact specifications of a specific team's workflow. That orchestration layer is exactly what our portfolio companies are building. Every model improvement is not a threat. It is fuel.This is precisely where Stackpoint operates.

Our studio builds domain-specific, agentic AI applications in sectors such as real estate, construction, financial services, hospitality, and insurance — industries with complex workflows, fragmented tools, and high willingness to pay for automation.

We do not carry capex risk.

We do not depend on winning the model-training arms race.

We capture the value made possible by it.

But being in the right part of the stack only matters if you can build something that's genuinely hard to replace. That's where a deep understanding of industry specific workflows becomes critical. As George Sivulka, founder of Hebbia, argues in a recent a16z piece: "Software is a stored process. It's not a neutral tool: it's an opinion for how a group of people should collaborate, encoded in a durable system." General-purpose AI tools — no matter how capable — cannot be opinionated in that way. Anthropic and OpenAI are building for every use case on earth at once. They cannot know how one compliance team's diligence process differs from the desk down the hall, or how a specific underwriter likes to structure their memos. That level of specificity is exactly where our portfolio companies operate — and where the real moat is built.

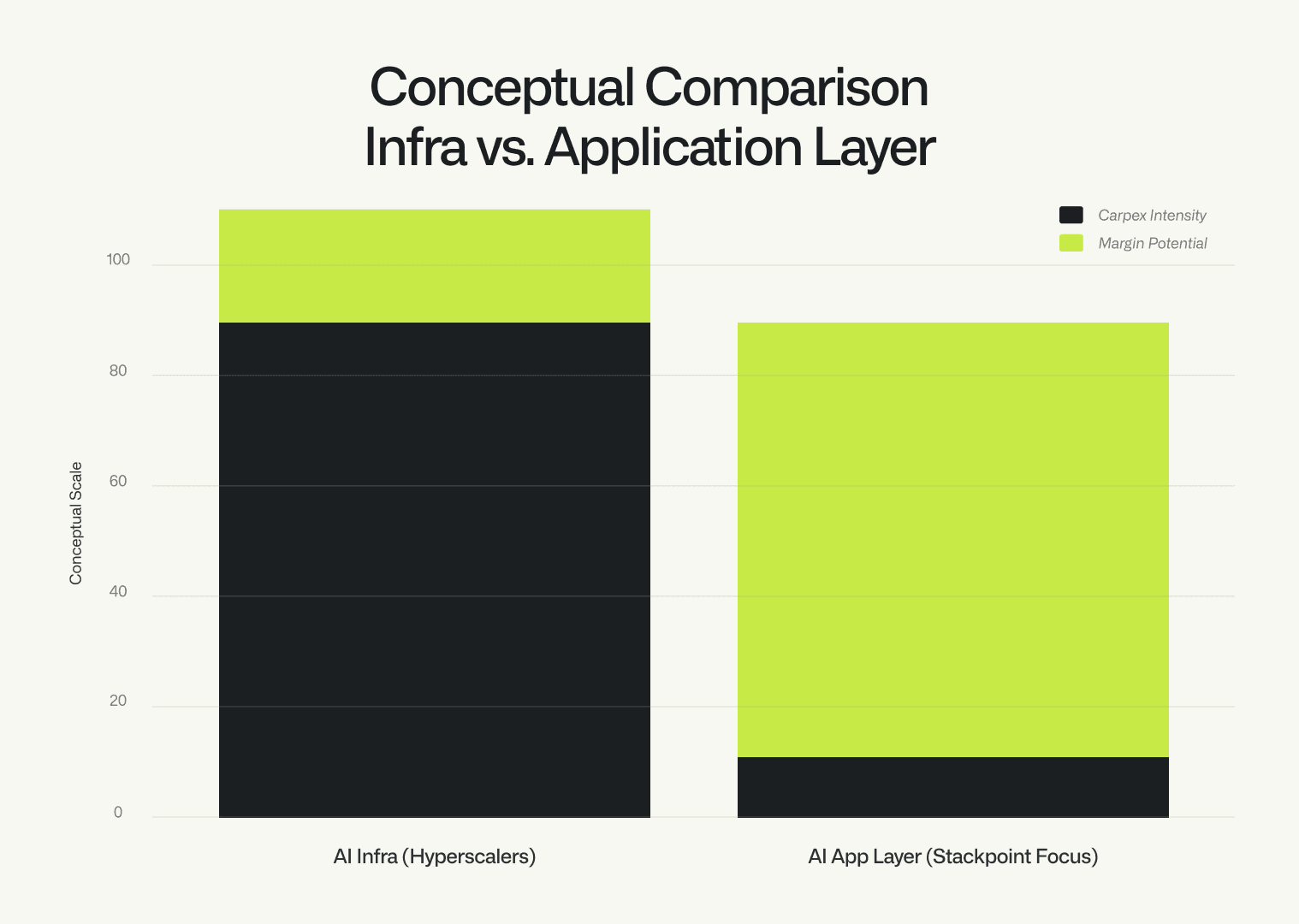

2. Capex-Light, Margin-Heavy by Design

While hyperscalers move toward asset-heavy models with deteriorating free cash flow, Stackpoint’s companies sit on the other side of that equation.

Our ventures are:

capex-light, with minimal infrastructure requirements and no hardware exposure

margin-heavy, delivering software and workflow automation with expanding long-term margins

positioned to benefit as model and inference costs fall in competitive cycles

As the cost of “intelligence” declines, our products become cheaper to deliver and more valuable to customers. That creates the type of operating leverage and expanding incremental margins associated with best-in-class software businesses — the same profiles most VCs try to add to their portfolios.

3. Diversified Across Verticals, Not Concentrated in a Single Arms Race

Today’s infrastructure buildout is highly concentrated: a handful of hyperscalers determine spending cycles, pricing dynamics, and market narrative. Investors exposed primarily to the bottom of the stack inherit that concentration risk.

Stackpoint’s structure is intentionally different. Each year, we launch companies across:

different industries

different buyer profiles

different demand cycles

different workflow problems

This diversification minimizes correlation to any single model provider, sector, or economic environment — a critical advantage if infrastructure markets become unstable.

For readers who want to understand why vertical AI companies behave differently than horizontal utilities, our writing on agentic AI and workflow-deep defensibility explores how integration, data, and process ownership create lasting advantages.

4. How We Operationalize This Advantage (and Reduce Risk)

Being in the right part of the stack isn’t enough. You also need disciplined company formation to avoid chasing noise.

Stackpoint mitigates risk before a single line of code is written.

Problem Selection First

We only build when multiple potential customers validate:

measurable ROI (labor-hour reduction, revenue expansion, cycle-time compression)

clear willingness-to-pay

measurable labor or cost reduction

clear adoption paths

This directly addresses the demand–overbuild gap that often characterizes tech bubbles. The This methodology is detailed in our article on how we evaluate new venture concepts, which outlines the multi-angle evaluation — market structure, economics, timing, competitive dynamics — behind each decision.

Design Partners From Day One

Every Stackpoint company begins with committed design partners who guide early product decisions, provide workflow insight, and accelerate deployment. This ensures the product is shaped by actual operators, not assumptions. This ensures:

validated value props

rapid iteration

early deployments

evidence of real-world adoption readiness

Model-Agnostic Architecture

We build for swap-ability across models and inference providers.

This lets us arbitrage capability-per-dollar as hyperscalers compete and prices fall — a prisoner’s dilemma dynamic Sparkline highlights.

Moats Built Through Data, Distribution, and Switching Costs

Rather than competing on model access, Stackpoint companies build advantages where AI value actually persists:

proprietary workflow and behavioral data

deep system integrations

switching costs created by embedded processes

multiplayer usage and ecosystem dependence

We explore how these workflow-deep moats shape long-term enterprise value in our analysis of early-stage AI opportunities, where vertical, embedded systems consistently outperform horizontal tools.

Bottom Line: We Are Built for This Moment

If the AI capex cycle continues accelerating, Stackpoint benefits from cheaper compute, better models, and broader adoption.

If the cycle slows or corrects, we remain insulated from capex exposure and maintain diversified, ROI-driven applications with real customers.

In both scenarios, the application layer — not the infrastructure layer — is where value pools form. That’s exactly where Stackpoint sits.

Our model is intentionally capex-light, ROI-first, and diversified across the industries where AI will create the biggest step-change impact. But more than that, we are building something that foundational models structurally cannot: the institutional knowledge of how specific teams, at specific firms, in specific industries actually do their work. The companies that win in vertical AI will win by doing the grinding institutional work, firm by firm, team by team, workflow by workflow, encoding how people actually operate into software that runs reliably at scale. That is what great vertical software empires have always been built on. And it is exactly what Stackpoint's portfolio companies are doing today.